Optimal Blue Issues February 2024 Originations Market Monitor

PLANO, Texas /CitizenWire/ — Today, Optimal Blue released its February 2024 Originations Market Monitor report, which reveals that the spring homebuying season has kicked off with a jump in monthly purchase mortgage locks. The seasonal spike in purchase locks propelled a net increase in origination activity, even as higher interest rates led to steep declines in mortgage refinances.

Key findings from the February 2024 Originations Market Monitor report, which reflects month-over-month changes in mortgage lock data, show:

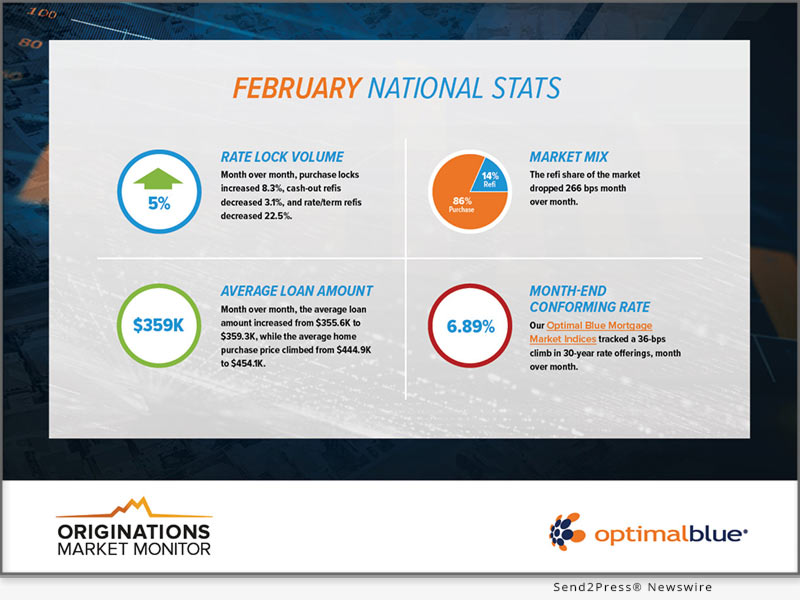

* Lock activity up despite steep decline in refinances: Rate lock volumes saw a 5% increase due to a notable 8.3% increase in purchase activity. The rise in purchase activity outpaced the decrease in refinancing activity, which fell by 22.5% for rate/term refinances and 3.1% for cash-out refinances.

* Purchase market nearing its floor: Purchase lock counts, which control for changing home prices, rose 7%, a significant growth compared to the 2% increase in the same period last year during a similar uptick in interest rates. The 7% year-over-year decline in lock activity was the smallest such drop since the Fed began hiking interest rates in March 2022.

* Interest rate trend reverses: The benchmark Optimal Blue Mortgage Market Indices (OBMMI) observed an end to three consecutive months of rate declines – the result of strong economic readings, which significantly lowered market expectations of a near-term rate cut. The OBMMI 30-year conforming rate index rose 36 bps to 6.89%, FHA rose 28 bps to 6.66%, VA rose 41 bps to 6.50%, and jumbo rose 37 bps to 7.35%.

* Non-conforming products see gains: Non-conforming loan products, including jumbo and non-QM loans, claimed an additional 183 basis points of market share, ending the month with 11% of the total volume. Meanwhile, conforming loans maintained a steady 57%, with slight decreases in FHA and VA loans.

* ARMs become slightly more popular: The rate increase nudged the share of ARM loans up, though they still account for only 6% of total production volume. The current economic scenario, particularly the inverted yield curve, will likely constrain further demand growth for these products.

* Credit quality and loan amounts continue upward trend: Credit quality continued to improve across all loan products, except VA loans, which held steady. The average loan amount increased from $355.6K to $359.3K, while the average home purchase price climbed from $444.9K to $454.1K.

“As the spring buying season commenced, we saw a resurgence in purchase locks, despite the rise in interest rates,” said Brennan O’Connell, director of data solutions at Optimal Blue. “Although lock counts were down on a year-over-year basis, the rate of decline is decelerating and suggests we may be nearing a floor for purchase lending in the current rate environment.”

View the full February 2024 Originations Market Monitor report for more detail: https://www2.optimalblue.com/wp-content/uploads/2024/03/OB_OMM_FEB2024_Report.pdf

About the OMM Report:

Each month, Optimal Blue issues the Originations Market Monitor report, which provides early insight into U.S. mortgage trends. Leveraging lender rate lock data from the Optimal Blue PPE – the mortgage industry’s most widely used product, pricing, and eligibility engine – the Originations Market Monitor provides a view of early-stage origination activity.

Nothing herein shall be construed as, nor is Optimal Blue providing, any legal, trading, hedging, or financial advice.

About Optimal Blue

Optimal Blue is a market leader in mortgage secondary marketing technology. The company facilitates transactions among mortgage market participants through its Marketplace Platform, actionable data, and technology vendor connections. The platform supports a range of functions for originators and investors to automate and optimize core processes related to product, pricing, and eligibility, hedge analytics, MSR valuation, loan trading, social media compliance, and counterparty oversight. The company’s premier products are used by 68% of the top 500 mortgage lenders in the U.S.

For more information on Optimal Blue’s end-to-end secondary marketing automation, visit https://OptimalBlue.com/.

Learn More: https://www2.optimalblue.com/

This version of news story was published on and is Copr. © 2024 CitizenWire™ (CitizenWire.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.